A Better Way To Manage Your Money

Spend wisely and confidently while achieving your financial goals. Track all your financial accounts, transactions, and investments in one app.

Your path to financial freedom

Stop living paycheck to paycheck. Build wealth with confidence using tools that actually work.

Track All Your Accounts in One Place

Seamlessly integrate all your financial accounts—checking, savings, credit cards, and investments—into Ploutos Budget for a complete financial overview.

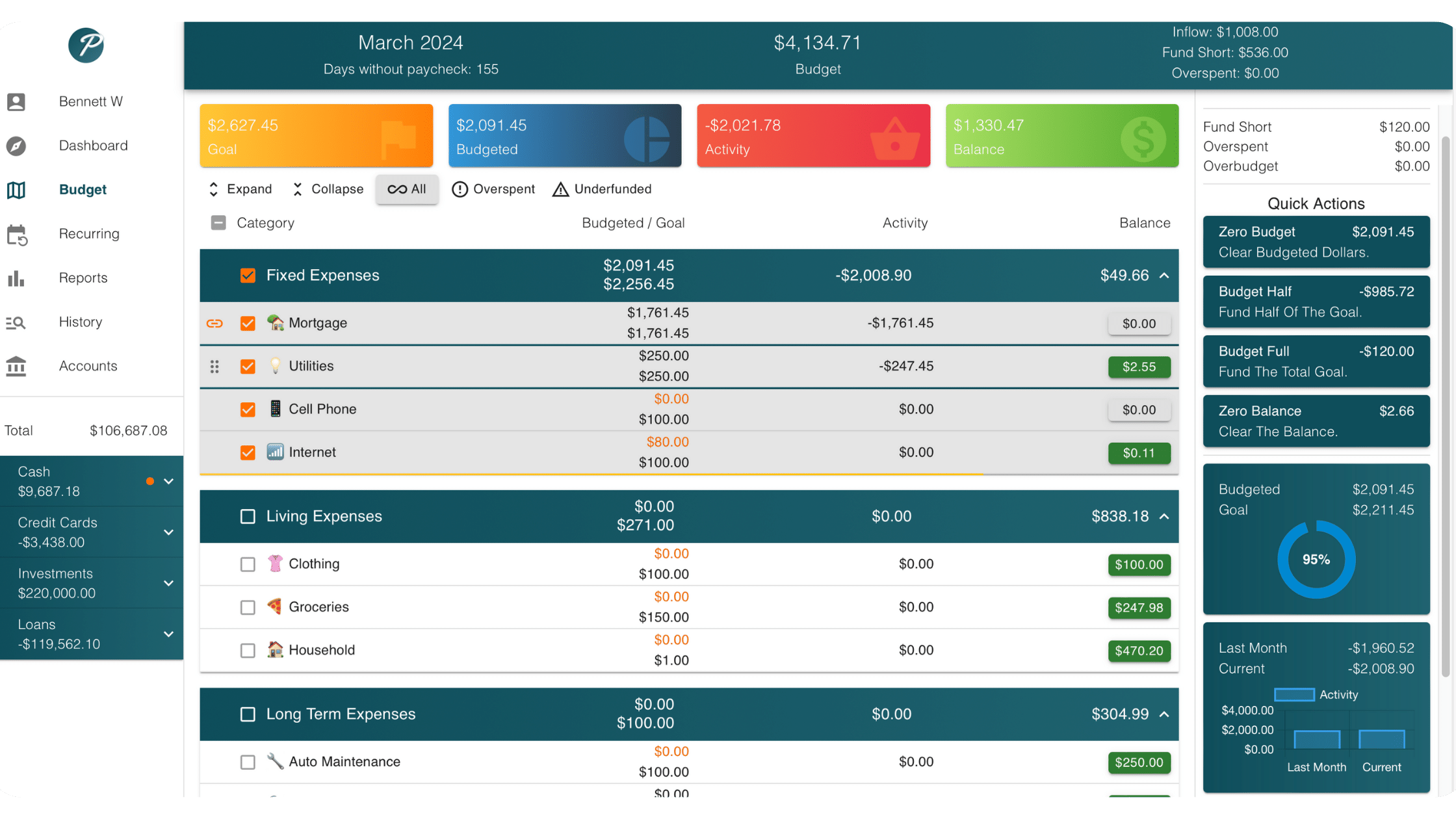

Set Personalized Financial Goals

Create customized monthly savings targets for each category, helping you prioritize spending and achieve your long-term financial objectives.

Allocate Your Funds Strategically

Easily distribute your available money across different categories based on your priorities, ensuring every dollar has a purpose.

Make Informed Spending Decisions

Real-time category balances give you clarity on exactly how much you can spend, eliminating guesswork and financial stress.

Everything you need in one place

One app for your entire financial life

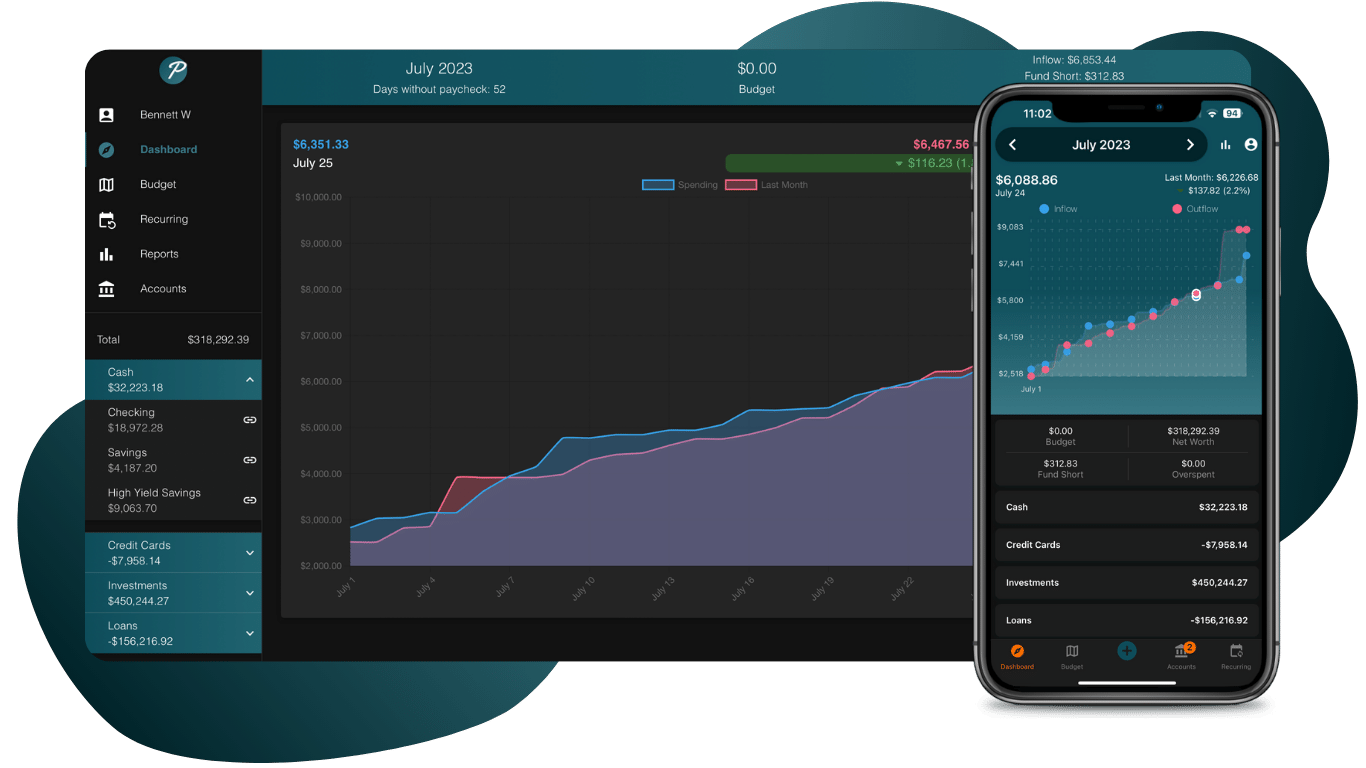

Unified Dashboard

See all accounts at once—checking, savings, credit cards, loans, and investments. Your complete financial picture in seconds.

Smart Categories

Create categories that match your life. Track what matters to you, from daily coffee to annual vacations.

Sinking Funds

Save for big expenses automatically. Spread annual costs across 12 months. No more financial surprises.

Auto-Sync

Connect your banks and transactions import automatically. Spend time planning, not entering data.

Investment Tracking

Monitor portfolio performance and asset allocation. See how investments fit into your total wealth picture.

Debt Management

Track loans and credit cards alongside your budget. Watch balances drop as you follow your plan.

Net Worth Reports

Track your true wealth over time. Visualize progress with charts that show your financial growth.

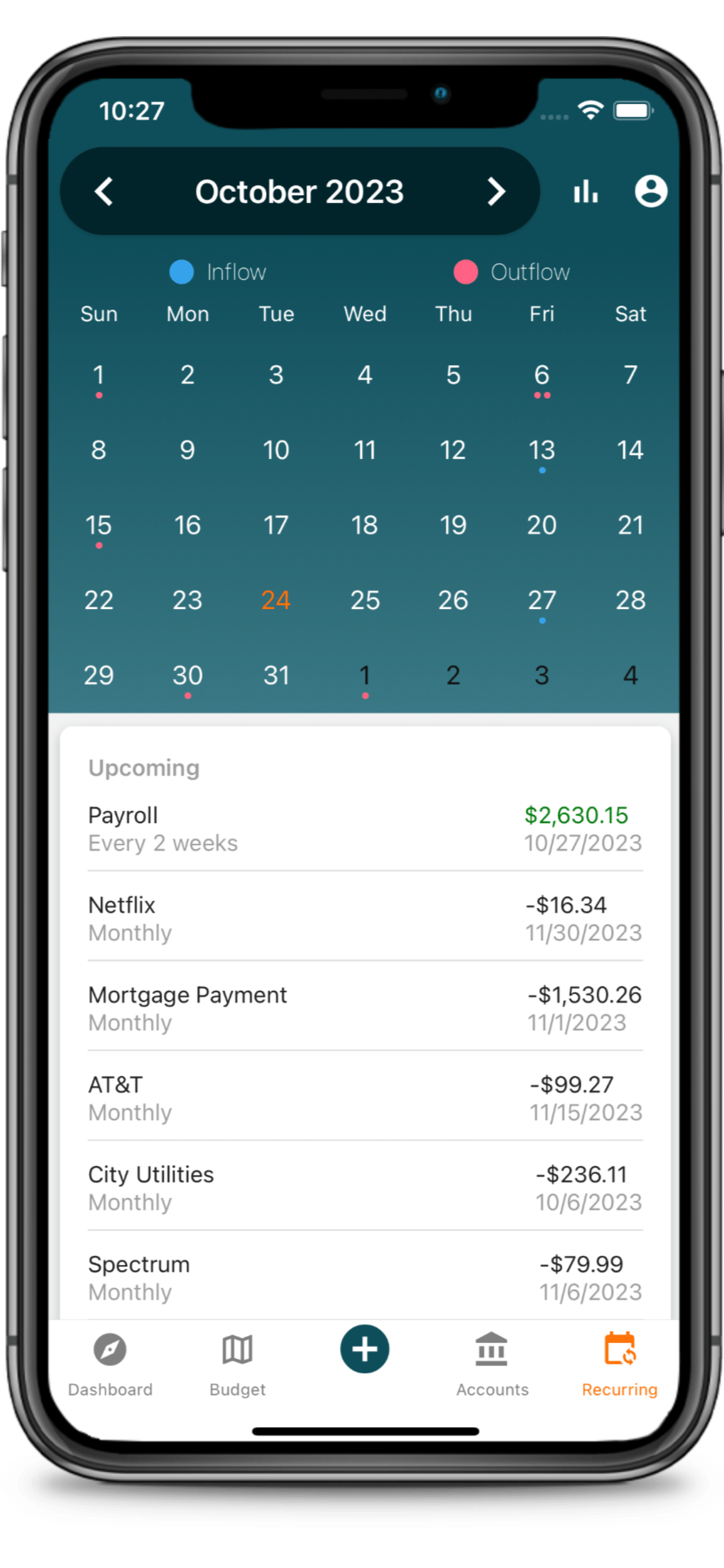

Recurring Calendar

Never miss a bill or subscription. See what's coming, giving you the opportunity to cancel or modify any service before you get charged.