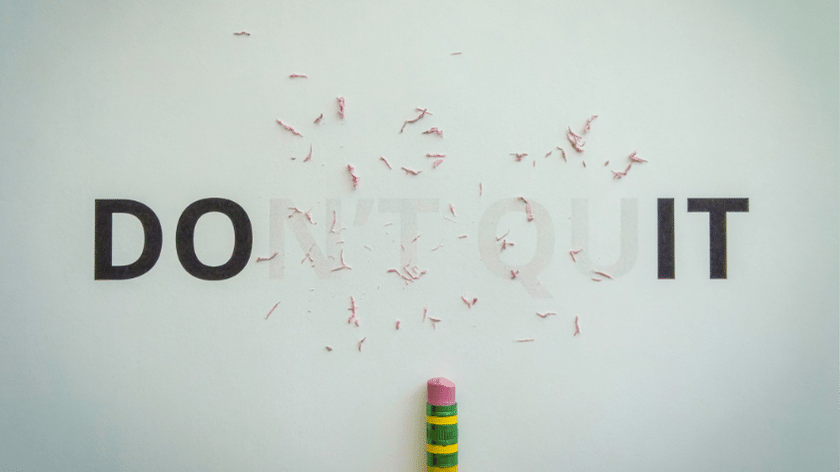

Going from zero to a detailed budget usually doesn’t happen in the first month and the motivation of why you thought you needed to start a budget fades just as fast as it arrived. People are very optimistic even if they don’t want to admit it. That is why most people don’t plan for anything to go wrong especially when it comes to finances. We will spend our entire paycheck leaving little to nothing for savings or a rainy day fund. It is usually when we get caught off guard by an unexpected expense that it hits us that we need to do a better job of planning for things like this in the future. So we start down the path of researching and learning how to better handle money, but we quickly lose motivation and all but stop. Let us go through some of the common pitfalls that cause most budgets to fail.

- Not Being Patient

- Not Tracking Expenses

- Drastic Cutbacks

- Unrealistic Plan

- Not Budgeting For Fun

- Going Over On Categories

- Don’t See Progress

Not Being Patient

The first thing we need to do is practice patience. We are not going to go from living paycheck-to-paycheck to a perfect budget with a fully funded emergency fund in a single month. Budgeting is a skill and just like any other skill it takes practice and time to get good at it.

Not Tracking Expenses

If you have never budgeted before the best place to start would be by just starting to track your expenses. You could even go through your last month’s bank statements to help you to get a general idea of how much you are spending on things like fuel, groceries, dining, or clothing.

Drastic Cutbacks

A common pitfall when someone new is first starting out is they are super motivated so they want to go all out. They look over every category to try to find places to cut back like digging through a couch cushion for lost coins. If you are a family currently spending $1,000 a month on groceries don’t expect to cut that in half in a single month. While we love the dedication to trying to hit your financial goals very few people will be able to make this 180 degree change on a dime. If you need to make large budget cuts on certain categories try to phase these cuts over a few months instead of all at once.

Unrealistic Plan

Your budget needs to reflect reality and an unrealistic budget is of no use because no one will be able to follow it. Some people will go from going to restaurants multiple times a week to not budgeting any money to a restaurant category for the month. The same would apply to our needs also. We can’t just not budget or underfund our basic living expenses thinking we will be able to live like that for long. We want our budget to be a realistic plan for our money that we can and want to stick to.

Not Budgeting For Fun

If you don’t budget or plan for anything fun or relaxing you are dooming your budget to failure. We can sacrifice for quite a while if we have a big enough “Why”, but that should be the exception not the norm. Some people are spenders and some people are savers and both groups need to have categories for fun spending.

Going Over On Categories

Give yourself time and grace to really understand your household spending. It is going to take several months of budgeting to really feel like you have it down. Stick with it and don’t give up. There is nothing wrong with having to pull money from another category because you underfunded a category. The important part is that you make the conscious decision to move the money from another category to cover the overspending.

Don’t See Progress

This is where apps like Ploutos Budget can shine. Being able to set goals and see your progress over time can help keep you on track and motivated. When in doubt, look back to our first point. PATIENCE. Hitting financial goals and winning with money takes time.

Our budget is nothing more than our plan for our money. We get to decide what we spend our money on and what our priorities are. A budget should not be restrictive but freeing.