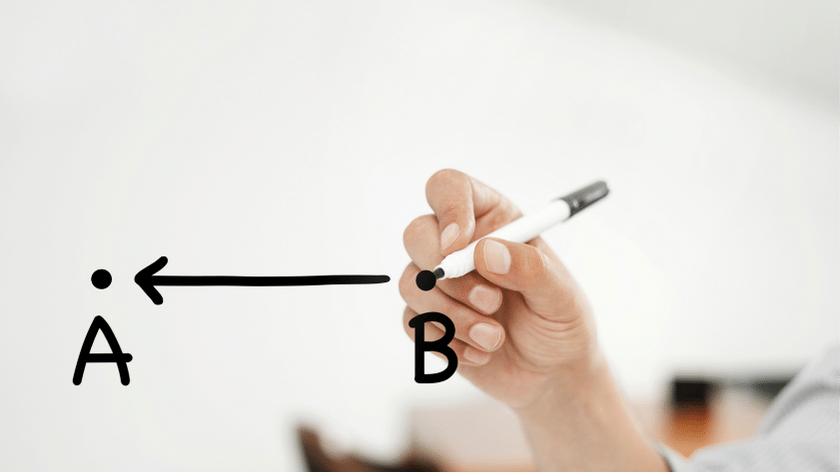

Inverted thinking is a way of thinking about problems that honestly you may have already heard of or tried yourself without realizing it. It is a framework established by Stoics such as Marcus Aurelius, Seneca, and Epictetus. Inverted thinking is the mental exercise of thinking about your problems backwards. While it is not a foolproof method to solve all of your problems it is a good exercise to help give you clarity.

How can we use inverted thinking to win with money? Maybe we aren’t sure how to get ahead or break the paycheck-to-paycheck cycle. But I bet we can think of ways to waste money very easily. While I know it is easier said than done, the reality is still the same. If we want to win with money then we need to avoid all the things that can destroy our financial health.

Start Tomorrow

When it comes to taking control of your finances this is the biggest killer. Putting off getting started is a sure fire way to make sure you stay right where you are financially and don’t get ahead. Making big life changes is never easy, but the best thing you can do is just start. It doesn’t need to be big drastic changes. Just start and start small. A half step in the right direction is better than no step at all.

Spend More Than You Make

If we want to make sure we are always broke and unable to save for a rainy day or retirement then spend every dollar you make before next payday. Better yet, use the credit card to spend more than you made. But in all seriousness, spend less than you make. Set aside money for savings before spending money on non-essential items. If you are looking for more guidance on how to prioritize your savings check out a previous article we wrote. How Should I Prioritize My Savings Goals?

Avoid A Budget At All Cost

I have heard the excuses of why you can’t, don’t want to, or you think you have a unique situation that prohibits you from being able to, but I will still shout it from the rooftops. Budget. It is not always easy, but it is a proven way to help you take control of your finances. Everyone is starting at a different place and some people definitely have it harder than others, but we can’t escape the reality that we all only have a finite amount of income each month. Budgeting will help you make the most of it.

Eat Out At Restaurants Every Chance You Get

I am not picking on people who love to order take-out or eat at restaurants. I could have used many examples here to get the point across of how some of us are wasting money. There is nothing wrong with wanting to eat at restaurants or get a coffee from the coffee shop, but doing it excessively can kill your financial health. Especially for those who are living paycheck-to-paycheck.

Don’t Have An Emergency Fund

It is hard to get ahead if we don’t have an emergency fund. We need to have money set aside for the inevitable fact that things will go wrong. Having an emergency fund gives you margin in your life. The flat tire on the way to work becomes a minor inconvenience instead of an emergency. Every time we get paid we should cover our necessities first. Then we should be setting aside money for short and long term savings. Our short term savings goal should be 3-6 months of our expenses (not income). After our necessities and savings for the month are covered, now we can spend money on non-essential items. If we are starting behind or at zero we are obviously not going to accomplish all of this in one month, but the goal is to be working towards it.

Asking ourselves before spending money if this helps us get closer or farther away from our financial goals can be a useful exercise, but I think you can go too far with it. We can and should still spend money on fun and frivolous things, but it should be within reason and not at the cost of our financial future.